Click the image for an enlarged version.

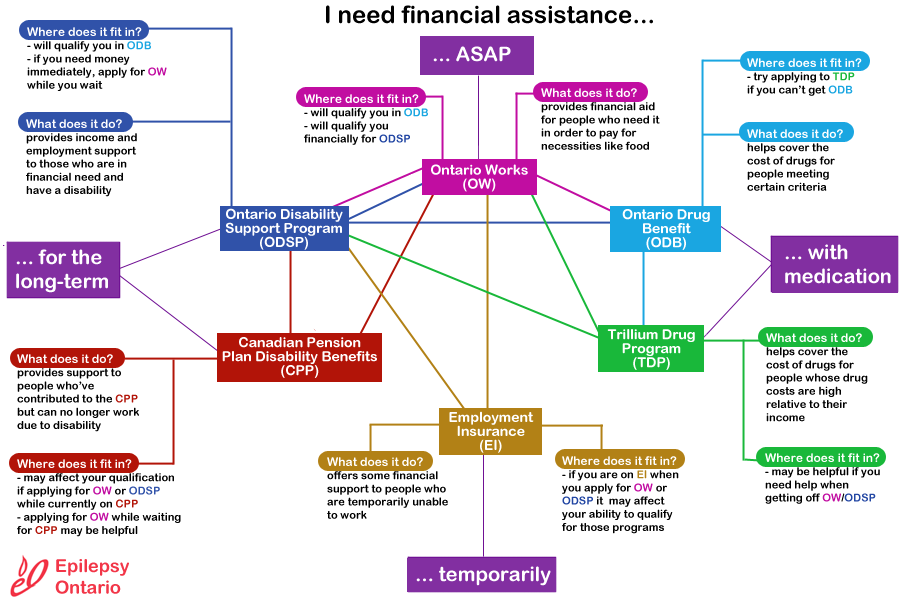

There are government programs available that can provide financial assistance to people living in Ontario. Some of these programs are interconnected, as shown in the above diagram. A short description of each program is shown in the diagram, and more detail about how each program relates to each other can be found below.

For more detailed information, go back to the previous webpage.

Ontario Disability Support Program (ODSP)

- If you receive social assistance through ODSP then you are eligible for the Ontario Drug Benefit.1

- Ontario Works (OW) is a faster process than ODSP, which can take several months, so if you need money urgently you can go to OW first and apply to ODSP through that program.

- If you apply to CPP while already on ODSP, note that it is deducted from ODSP dollar-for-dollar2 and if you get it, it could cut off your ODSP if it is higher than your ODSP entitlement.3

Canadian Pension Plan (CPP) Disability Benefits

- If you’re already on CPP and you’re applying for ODSP or OW, it might make you financially ineligible4 but you can get into ODSP first and then go on CPP. You will get less or even no money from ODSP (see above) but you might still get ODSP benefits.

- OW is a faster process than CPP, which can take several months, so you can also apply to OW first and then go to CPP.

Employment Insurance (EI)

- EI is considered income in OW and ODSP so if you are on EI, you might not get qualify for ODSP or OW.5

Trillium Drug Program (TDP)

- If you still need help to cover your medication costs after you get off ODSP or OW, you can apply to the TDP.

Ontario Drug Benefit (ODB)

- If you don’t qualify for the ODB and your medication costs are high relative to your income, try applying to the TDP.

Ontario Works (OW)

- If you receive social assistance through OW then you are eligible for the Ontario Drug Benefit.6

- If you’re on OW and you want to apply to ODSP, you already meet the financial criteria, so you only need to prove that you fit the criteria of a “person with a disability”.

- Canadian Pension Plan Disability Benefits and Employment Insurance are deducted from Ontario Works. This means that for every dollar you receive in CPP or EI, you get a dollar deducted from your OW payment.7

1 http://www.health.gov.on.ca/en/public/programs/drugs/programs/odb/odb.aspx

2 http://www.communitylegalcentre.ca/legal_information/im/CPP-D/FAQ.htm

3 http://www.durhamcommunitylegalclinic.ca/Income-Support/CPP-Disability-Benefits/Introduction.html

4 http://www.legalclinic.ca/faq.html#cpp

5 http://kclc.ca/legal_ei.cfm

6 http://www.health.gov.on.ca/en/public/programs/drugs/programs/odb/odb.aspx

7 http://www1.toronto.ca/wps/portal/contentonly?vgnextoid=9164ac30050d0410VgnVCM10000071d60f89RCRD&vgnextchannel=f0d564445c780410VgnVCM10000071d60f89RCRD, http://www.mcss.gov.on.ca/documents/en/mcss/social/directives/ow/0501.pdf, http://www.mcss.gov.on.ca/documents/en/mcss/social/directives/odsp/income_Support/5_1.pdf